48+ how much of your income should your mortgage be

John in the above example makes. Well Help You Estimate Your Monthly Payment.

What Percentage Of Your Income Should Go To Mortgage Chase

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income.

. Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just. Apply See If Youre Eligible for a Home Loan Backed by the US. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. A lender suggests to not. For conventional loans most lenders focus on your back-end ratio.

Web The 2836 is based on two calculations. Contact a Loan Specialist. Find An Online Mortgage Lender With A Great Mortgage Rate.

Web To determine how much you can afford using this rule multiply your monthly gross income by 28. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Calculate and See How Much You Can Afford.

Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Get an idea of your estimated payments or loan possibilities. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Were not including any expenses in estimating the. Ad Are you eligible for low down payment. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Find all FHA loan requirements here. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Get Your Quote Today.

A front-end and back-end ratio. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Find An Online Mortgage Lender With A Great Mortgage Rate.

Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Lock In Your Low Rate Today. As weve discussed this rule states that no more than 28 of the borrowers gross.

Start By Checking The Requirements. For example if you make 10000 every month multiply 10000 by 028 to get. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. For example say your monthly debt expenses equal 3000. Ad See how much house you can afford.

And they see a 28 DTI as an excellent one. Web Once the average income is determined a mortgage lender will confirm the DTI and recommend an eligible monthly mortgage payment. Web The 35 45 Model.

Web Lenders use your debt-to-income ratio DTI as a measure of affordability. Web Lenders calculate your debt-to-income ratio by dividing your monthly debt obligations by your pretax or gross income. Ad Need To Know How Much You Can Afford.

Estimate your monthly mortgage payment. Assume your gross monthly. Compare Home Financing Options Online Get Quotes.

In order to calculate how much mortgage you can afford with this model figure. Web Sum of Monthly Debts Pre-Tax Monthly Income 100 Your DTI. Most lenders look for a ratio of 36 or less although.

Web While the Consumer Financial Protection Bureau CFPB reports that banks will qualify mortgage amounts that are up to 43 of a borrowers monthly income you might not want to take on that much debt. Try our mortgage calculator. VA Loan Expertise and Personal Service.

Ideal debt-to-income ratio for a mortgage. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent.

Another rule some homeowners subscribe to is the 35 45 model which states that your total monthly debt including your mortgage installment shouldnt exceed 35 of your pre-tax income or 45 of your post-tax income. Ideally that means your monthly. This rule says that you should not spend more than 28 of.

Are You Eligible For The VA Loan.

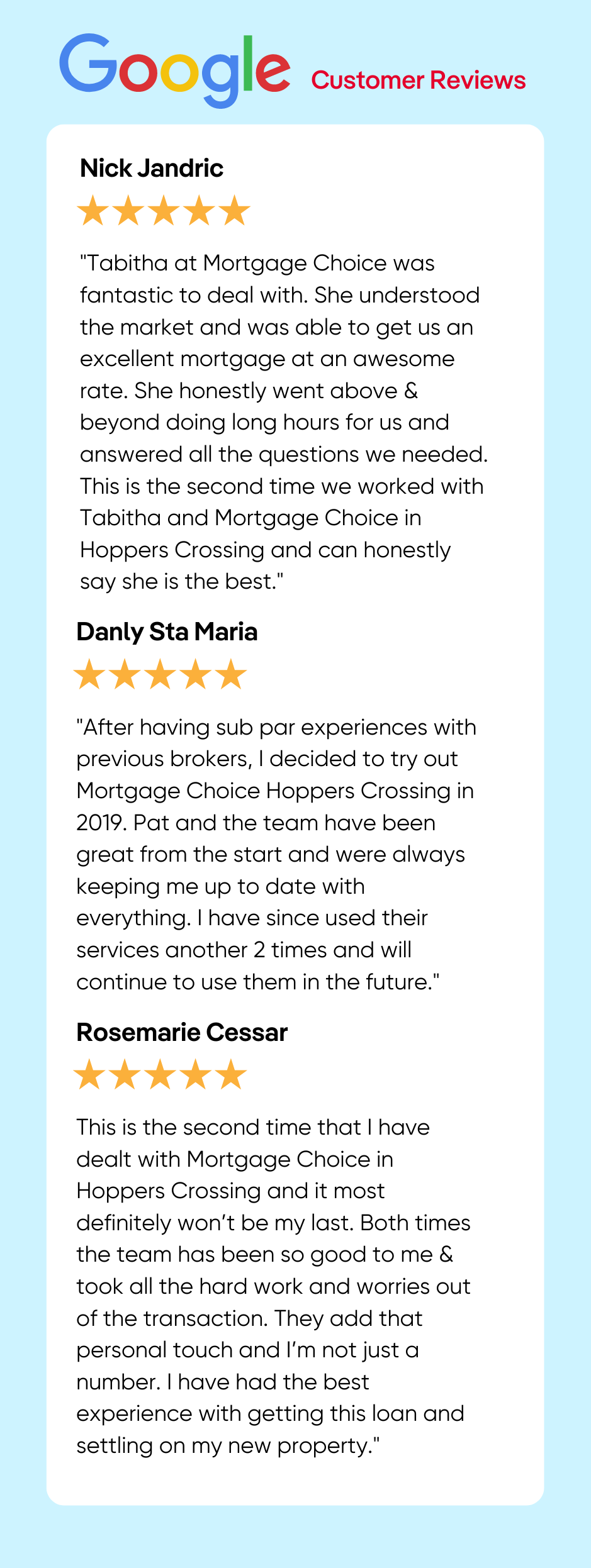

Your Local Mortgage Broker Team In Hoppers Crossing Mortgage Choice

The U S Is The Most Overworked Nation In The World

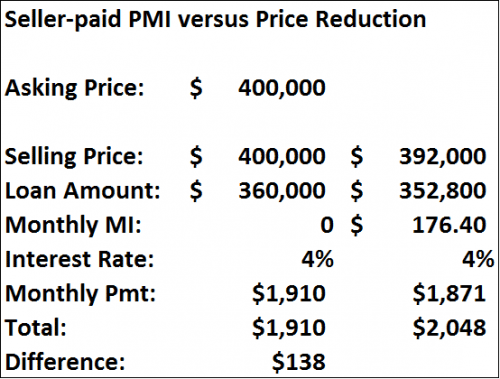

9 Ways To Keep Your Mortgage Payments Low Mortgage Rates Mortgage News And Strategy The Mortgage Reports

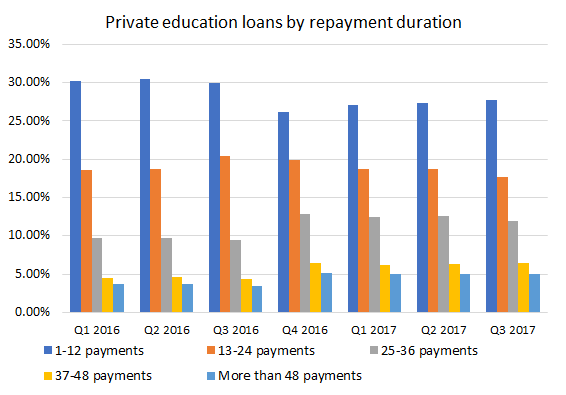

Shorting The Student Loan Bubble With Sallie Mae Nasdaq Slm Seeking Alpha

How Much House Can You Afford Readynest

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Interest Only Calculator Excel Template Step By Step Video Tutorial By Simple Sheets Youtube

The Percentage Of Income Rule For Mortgages Rocket Money

Selling And Sales Management Index Of

What Percentage Of Income Should Go To Mortgage Morty

How Much Home Can You Afford Advanced Topics

What Percentage Of Your Income Should Go To Mortgage Chase

How Much House Can I Afford Moneyunder30

How Much Home Can I Afford Mortgage Affordability Calculator

How Much House Can I Afford The Motley Fool

326 By Steurbaut Issuu

How Much Mortgage Can I Qualify For In Nyc Hauseit